But within two days of the show’s airing, WeChat saw some 200 million bank cards added to the WeChat Pay system. WeChat Pay was the first interactive sponsor of the CCTV gala in 2014, and it had less than 8 million users before the broadcast. In “ The Secret to China's Mass Adoption of Tech ,” I explained how financial incentives have subsidized China's tech adoption, especially when it comes to payment services. The big internet players fight for the right to bestow loads of money for a reason. Since 2014, one lucky tech company has been named to give away “lucky money” (aka red envelopes/red packets, or hongbao, 红包) to viewers during the hours-long broadcast. Over the past week or so, Chinese media has been abuzz with rumors that Douyin would take over the exclusive contract for the interactive partnership of CCTV’s Spring Festival Gala, which is viewed by pretty much all of China (no joke, it had an audience of 1.23 billion in 2020 ) during the eve of the Lunar New Year, functioning as a familiar backdrop during family gatherings for the holiday. Partnering With CCTV’s Spring Festival Gala But one thing will definitely help with its user acquisition. So Douyin has a lot of catching up to do.

#DOUYIN BYTEDANCE CHINESE PAY WECHAT PAY OFFLINE#

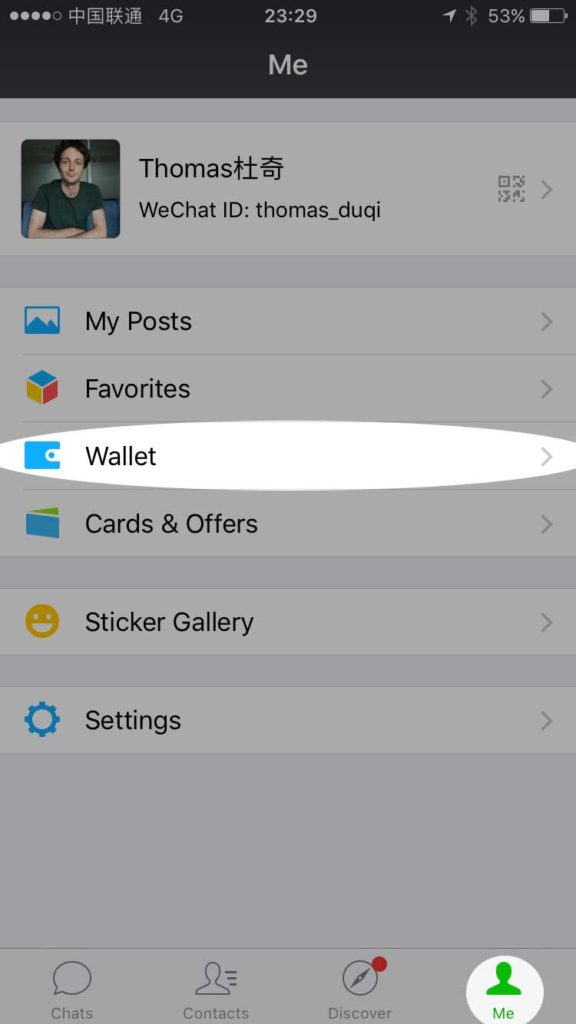

The latter will take a lot of time, as Alipay and WeChat Pay have become the standard for both online and offline commerce. So Douyin's upcoming priorities are, first, to get people to sign up for its payments service, and, second, to get vendors on board.

Of course, Douyin hasn’t immediately shut out the competition, since both Alipay and WeChat options are still available to its users. See, for example, Kuaishou, which doesn't (yet) control the entire commerce loop and remains dependent on Alibaba and Tencent. Without the payment element, internet companies remain dependent on the likes of Alipay and WeChat Pay to complete transactions. For any platform-based firm, the payment link is key to the establishment and growth of its internal platform economy. This is very likely to change as Douyin gains market share, but it represents a valuable proposition for users. So every yuan in transaction fees that goes to Alipay or WeChat Pay is a yuan lost to a competitor.Īnd thus, on January 20, Douyin Pay was launched, operating with an initial no-fee policy - unlike Alipay and WeChat Pay, which both have fees for withdrawals and transfers by users and third parties. Internet companies in China mostly operate in a zero-sum environment: you either win or lose. Obviously, the platform bears these costs, not the user. When users objected (fervently), Meituan founder Wang Xing pointed out that his company had to cover processing fees for Alipay and rival Tencent ’s WeChat Pay. In July 2020, Meituan temporarily canceled the use of Alipay on its platform. In the Chinese market, if you want to compete as an ecosystem or a platform, you must control all transactions. Here’s what they’ll do to guarantee their ascendancy at home in China over the course of 2021.ġ. But the gloves are coming off for Douyin this year.

It's the Chinese version of TikTok, the innocuous fun factory your baby nephew and mom are addicted to. Who can boast the following triple whammy?Įxclusive partnership to sponsor CCTV’s Spring Festival Gala.

0 kommentar(er)

0 kommentar(er)